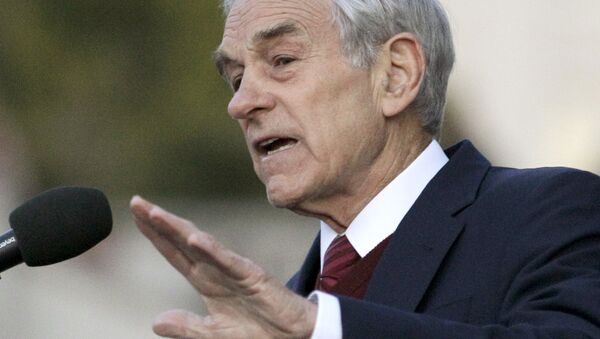

In a column published on his website Sunday, Paul blamed the crash on flawed monetary policy from the Fed, and not on China’s recent currency devaluation, as many experts said.

"The Federal Reserve's inflationary policies distort the economy, creating bubbles, which in turn create a booming stock market and the illusion of widespread prosperity. Inevitably, the bubble bursts, the market crashes, and the economy sinks into a recession," said the former congressman from Texas.

An increasing number of American lawmakers have incorrectly proposed fixing flaws in the US monetary system by forcing the Fed to follow a "rules-based" monetary policy, Paul said.

"Forcing the Fed to 'follow a rule' does not change the fact that giving a secretive central bank the power to set interest rates is a recipe for economic chaos. Interest rates are the price of money, and, like all prices, they should be set by the market, not by a central bank and certainly not by Congress," he said.

Rather, Congress should begin restoring a free-market monetary system, according to Paul.

"The first step is to pass the Audit the Fed legislation so the people can finally learn the full truth about the Fed. Congress should also pass legislation ensuring individuals can use alternative currencies free of government harassment," said the former presidential candidate.

"When bubbles burst and recessions hit, Congress and the Federal Reserve should refrain from trying to 'stimulate' the economy via increased spending, corporate bailouts, and inflation. The only way the economy will ever fully recover is if Congress and the Fed allow the recession to run its course."

Not only is China not to blame for the crash, but Beijing’s large purchase of US Treasury notes helped the United States "postpone the day of reckoning," Paul continued.

"The main reason countries like China are eager to help finance our debt is the dollar’s world reserve currency status. However, there are signs that concerns over the US government’s fiscal irresponsibility and resentment of our foreign policy will cause another currency (or currencies) to replace the dollar as the world reserve currency. If this occurs, the US will face a major dollar crisis."

Moreover, many Americans falsely believe they must sacrifice their liberties in order to obtain economic and personal security, Paul said.

"Eventually the United States will have to abandon the warfare state, the welfare state, and the fiat money system that fuels leviathan's growth. Hopefully the change will happen because the ideas of liberty have triumphed, not because a major economic crisis leaves the government with no other choice."