https://sputnikglobe.com/20230802/what-are-fitch-ratings-and-what-does-uss-downgrade-mean-for-other-nations-1112344239.html

What are Fitch Ratings and What Does US’ Downgrade Mean for Other Nations?

What are Fitch Ratings and What Does US’ Downgrade Mean for Other Nations?

Sputnik International

What are Fitch ratings? How important are they? How do major economies like China rank? Sputnik explores.

2023-08-02T12:58+0000

2023-08-02T12:58+0000

2023-08-02T14:44+0000

janet yellen

joe biden

russia

china

ukraine

fitch

moody’s

fitch ratings

s&p

ratings

https://cdn1.img.sputnikglobe.com/img/19144/82/191448213_0:156:3000:1844_1920x0_80_0_0_ba56ee7e207cafea469bd31e3273208f.jpg

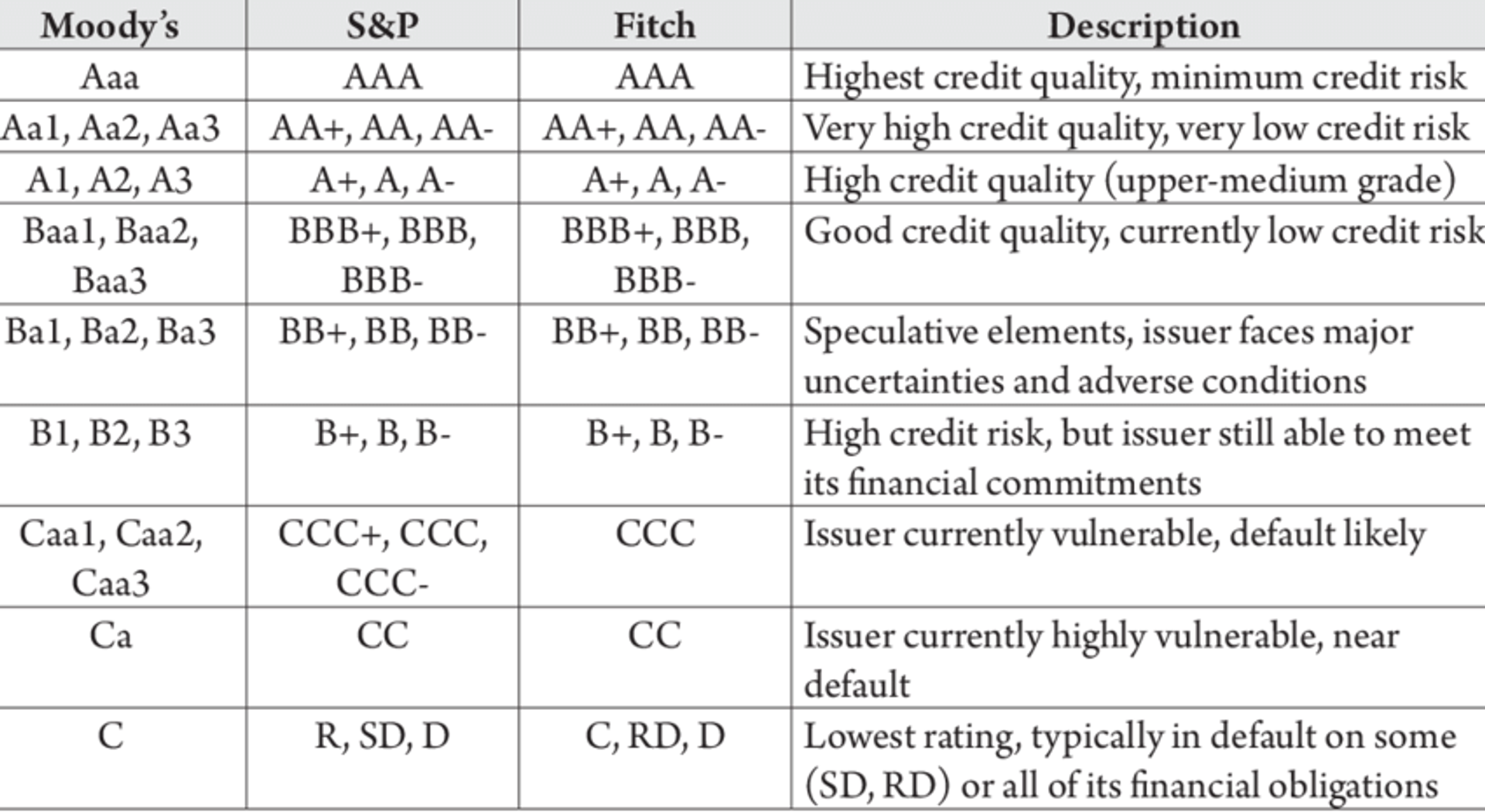

Fitch Ratings has downgraded the US’ credit rating from AAA to AA+, citing an "expected fiscal deterioration" in the country’s finances "over the next three years, a high and growing government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades."As evidence of this "erosion of governance," Fitch cited the last-minute debt deal reached in June, as the country teetered on the brink of defaulting on its gargantuan $32.7 trillion national debt."I strongly disagree with Fitch Ratings’ decision," Treasury Secretary Janet Yellen said in a statement following the downgrade, calling it "arbitrary and based on outdated data."What are Fitch Ratings?Fitch is one of three major Western rating agencies, and is dual-headquartered in New York City and London. The other two, Moody’s and S&P Global Ratings, also have their HQs in New York City.Along with the big three, the US Securities and Exchange Commission also recognizes about half a dozen other rating agencies, including AM Best, based in New Jersey, DBRS Morningstar, headquartered in Toronto, Canada, Demotech from Columbus, Ohio, Egan-Jones Ratings from Haverford, Pennsylvania, HR Ratings de Mexico, Japan Credit Rating Agency, and Kroll Bond Rating Agency, also from New York.Fitch structures its rankings on a dual ledger, including AAA, AA+, AA, AA-, A+, A and A- for its prime, high-grade and upper medium grade rating, and down the line to a “C,” with CCC- to CCC+, listed as carrying "substantial risks," CC as "extremely speculative," and “C” as "default imminent." An actual default is marked as RD or D.Moody’s and S&P have a similar ranking system, with only minor differences. A simplified F1+ to C credit scale exists for short-term credit.Why are Countries' Credit Ratings Important?Whether for individuals, companies, or entire nations, credit ratings are designed to objectively evaluate risks associated with lending money to that person, firm, or country, and to forecast the risk of default (i.e. being unable to meet loan obligations).Sovereign credit ratings – which deal specifically with risks associated with lending to countries, are additionally designed to provide potential investors with indicators of how risky pouring money into a particular nation might be, and focus not only on national economic indicators, but on so-called "political risk," or investor or loan provider-related risk stemming from a nation’s political decisions or political events.How Do Credit Ratings Affect Market Psychology?While proponents of classical liberal economics often refer to the "invisible hand" guiding markets to optimal, balanced, and fair outcomes based on individual self-interest, the reality is that psychology – confidence or lack of confidence among investors, producers, and consumers plays a major, if not decisive role in determining demand, production, and willingness to invest or make loans.In the case of national credit ratings, the monopolization of rating agencies, combined with the subjectively determined "political risk" factor, can often play a major discriminatory role in a nation’s ranking, and its ability or inability to secure credit and investment.For example, while the US Treasury has gone ballistic over Fitch’s "arbitrary" AA+ rating, despite ample fundamentals-based evidence that the United States’ creditworthiness can be called into question, China – the global manufacturing giant sometimes dubbed the "workshop of the world," is forced to make do with an A+ rating, which is only "upper medium grade." Meanwhile, Russia, endowed with the wealth of the entire periodic table of elements and accounting for 10-15 percent global oil and natural gas output, has been slapped with a CCC rating, just a few rungs above “default” status.And this in spite of the fact that Russia and China’s national debt to GDP ratio is nowhere near as large as that of the US, (15.5 percent and 77 percent, compared with 120 percent, respectively), and the fact that both countries’ monetary policymakers would never allow so-called quantitative easing (or, put simply, money printing) to the same degree that America’s fiscal authorities do.Are Credit Ratings Politicized?The politicization of credit ratings, either to soften the blow from the actual economic realities, or to deliberately target a country and scare away investors and creditors, plays a largely invisible, but important role in the big three ratings agencies’ calculations.Russia began noticing the "politicization" of Western credit rating agencies in 2015 in connection with the Ukraine crisis, with Moscow launching its own Russian Analytical Credit Ratings Agency. Then Deputy Foreign Minister Vasily Nebenzya, who now serves as Russia’s permanent representative to the UN, accused Western agencies of engaging in "politicized, biased and politically motivated" efforts to try to undermine Russia’s economy.China leveled similar accusations against Moody’s and S&P in 2016 after they lowered the nation’s sovereign outlook, with Beijing pointing out that the historic market performance of most of the People’s Republic’s sovereign debt has consistently been above the assessment of credit ratings agencies, and "that means there’s bias."Allegations of the politicized employment of the big three credit agencies aren’t limited to America’s adversaries, either. In 2010, with the euro climbing to historic highs against the dollar, Moody’s famously downgraded Greece’s sovereign rating by four notches to "junk" status, and then by another three notches a year later, plunging the bloc’s currency into a collapse which it has never recovered from.Brussels never formally accused Washington of putting its thumb on the scale and nudging Moody’s toward its decision on Greece, but the recent experiences of European countries, which face the threat of deindustrialization as the Biden administration offers incentives to energy-hungry industries to move to the US amid NATO’s proxy war with Russia in Ukraine, shows that US officials certainly aren’t above such behavior.In other words, the big three credit rating agencies have repeatedly been caught fiddling with countries’ creditworthiness ratings for the sake of political goals. The only question is that if Fitch has been forced to downgrade the US’ rating, how bad could the country’s situation be in reality?Washington is known to be facing a perfect storm of economic bad news, teetering on the brink of recession (or even already being in one, by some measures), and facing the unenviable prospect of the loss of the dollar’s status as the world’s de facto reserve currency, which would deprive the nation of hundreds of billions of dollars’ worth of real goods, resources, and services, which it currently gets in exchange for its green pieces of paper.Which Countries Enjoy Triple A Ratings?With the US dropping off the pedestal of Fitch’s "highest credit quality" rated nations, only a handful of countries in the world maintain the coveted AAA rating among the big three agencies, among them Australia, Denmark, Germany, Luxembourg, the Netherlands, Switzerland, Norway, Sweden, and Singapore.Other major economies’ rankings vary, from BBB- for India (the lowest rung of "lowest medium grade") to A or A+ for Japan ("upper medium grade"), BBB for Indonesia, BB- or BB for Brazil (“non-investment grade speculative”), AA or AA- for France and the UK.

https://sputnikglobe.com/20230801/fitch-downgrades-us-credit-rating-over-anticipated-fiscal-deterioration-1112331768.html

https://sputnikglobe.com/20230725/us-regulator-accuses-lenders-of-fiddling-with-deposit-data-after-banking-collapse-close-call-1112126430.html

https://sputnikglobe.com/20230730/germany-may-face-irreversible-deindustrialization---cdu-chair-1112257349.html

https://sputnikglobe.com/20230702/jim-rogers-de-dollarization-fuelled-by-soaring-us-debt-1111626237.html

russia

china

ukraine

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

2023

News

en_EN

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

Sputnik International

feedback@sputniknews.com

+74956456601

MIA „Rosiya Segodnya“

fitch ratings, sovereign credit rating, rating, credit, debt, downgrade, united states, aaa, what are fitch ratings, why is a country's credit rating important, how do credit ratings affect market psychology, are ratings politicized, who has aaa ratings

fitch ratings, sovereign credit rating, rating, credit, debt, downgrade, united states, aaa, what are fitch ratings, why is a country's credit rating important, how do credit ratings affect market psychology, are ratings politicized, who has aaa ratings

Fitch Ratings has

downgraded the US’ credit rating from AAA to AA+, citing an "expected fiscal deterioration" in the country’s finances "over the next three years, a high and growing government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades."

As evidence of this "erosion of governance," Fitch cited the last-minute debt deal reached in June, as the country teetered on the brink of defaulting on its gargantuan

$32.7 trillion national debt.

"I strongly disagree with Fitch Ratings’ decision," Treasury Secretary Janet Yellen said in a statement following the downgrade, calling it "arbitrary and based on outdated data."

Fitch is one of three major Western rating agencies, and is dual-headquartered in New York City and London. The other two, Moody’s and S&P Global Ratings, also have their HQs in New York City.

Along with the big three, the US Securities and Exchange Commission also

recognizes about half a dozen other rating agencies, including AM Best, based in New Jersey, DBRS Morningstar, headquartered in Toronto, Canada, Demotech from Columbus, Ohio, Egan-Jones Ratings from Haverford, Pennsylvania, HR Ratings de Mexico, Japan Credit Rating Agency, and Kroll Bond Rating Agency, also from New York.

Fitch, Moody’s, and S&P Global together constitute 95 percent of the global credit rating market. The concentration of major rating agencies in a handful of countries (and in the big three’s case, just two cities) endow the West, and particularly the United States, with immense economic power. But more on this below.

Fitch structures its rankings on a dual ledger, including AAA, AA+, AA, AA-, A+, A and A- for its prime, high-grade and upper medium grade rating, and down the line to a “C,” with CCC- to CCC+, listed as carrying "substantial risks," CC as "extremely speculative," and “C” as "default imminent." An actual default is marked as RD or D.

Moody’s and S&P have a similar ranking system, with only minor differences. A simplified F1+ to C credit scale exists for short-term credit.

Why are Countries' Credit Ratings Important?

Whether for individuals, companies, or entire nations, credit ratings are designed to objectively evaluate risks associated with lending money to that person, firm, or country, and to forecast the risk of default (i.e. being unable to meet loan obligations).

Sovereign credit ratings – which deal specifically with risks associated with lending to countries, are additionally designed to provide potential investors with indicators of how risky pouring money into a particular nation might be, and focus not only on national economic indicators, but on so-called "political risk," or investor or loan provider-related risk stemming from a nation’s political decisions or political events.

How Do Credit Ratings Affect Market Psychology?

While proponents of classical liberal economics often refer to the "invisible hand" guiding markets to optimal, balanced, and fair outcomes based on individual self-interest, the reality is that psychology – confidence or lack of confidence among investors, producers, and consumers plays a major, if not decisive role in determining demand, production, and willingness to invest or make loans.

In the case of national credit ratings, the monopolization of rating agencies, combined with the subjectively determined "political risk" factor, can often play a major discriminatory role in a nation’s ranking, and its ability or inability to secure credit and investment.

For example, while the US Treasury has gone ballistic over Fitch’s "arbitrary" AA+ rating, despite ample fundamentals-based evidence that the United States’ creditworthiness can be called into question, China – the global manufacturing giant sometimes dubbed the "workshop of the world," is forced to make do with an A+ rating, which is only "upper medium grade." Meanwhile, Russia, endowed with the wealth of the entire periodic table of elements and accounting for 10-15 percent global oil and natural gas output, has been slapped with a CCC rating, just a few rungs above “default” status.

And this in spite of the fact that Russia and China’s national debt to GDP ratio is nowhere near as large as that of the US, (15.5 percent and 77 percent, compared with 120 percent, respectively), and the fact that both countries’ monetary policymakers would never allow so-called quantitative easing (or, put simply, money printing) to the same degree that America’s fiscal authorities do.

Are Credit Ratings Politicized?

The politicization of credit ratings, either to soften the blow from the actual economic realities, or to deliberately target a country and scare away investors and creditors, plays a largely invisible, but important role in the big three ratings agencies’ calculations.

Russia began noticing the "politicization" of Western credit rating agencies in 2015 in connection with the Ukraine crisis, with Moscow launching its own

Russian Analytical Credit Ratings Agency. Then Deputy Foreign Minister Vasily Nebenzya, who now serves as Russia’s permanent representative to the UN,

accused Western agencies of engaging in

"politicized, biased and politically motivated" efforts to try to undermine Russia’s economy.China leveled similar accusations against Moody’s and S&P in 2016 after they lowered the nation’s sovereign outlook, with Beijing

pointing out that the historic market performance of most of the People’s Republic’s sovereign debt has consistently been above the assessment of credit ratings agencies, and

"that means there’s bias."Allegations of the politicized employment of the big three credit agencies aren’t limited to America’s adversaries, either. In 2010, with the euro climbing to historic highs against the dollar, Moody’s famously downgraded Greece’s sovereign rating by four notches to "junk" status, and then by another three notches a year later, plunging the bloc’s currency into a collapse which it has never recovered from.

Brussels never

formally accused Washington of putting its thumb on the scale and nudging Moody’s toward its decision on Greece, but the recent experiences of European countries, which

face the threat of deindustrialization as the Biden administration offers incentives to energy-hungry industries to move to the US amid

NATO’s proxy war with Russia in Ukraine, shows that US officials certainly aren’t above such behavior.

In other words, the big three credit rating agencies have repeatedly been caught fiddling with countries’ creditworthiness ratings for the sake of political goals. The only question is that if Fitch has been forced to downgrade the US’ rating, how bad could the country’s situation be in reality?

Washington is known to be facing a perfect storm of economic bad news, teetering on the brink of recession (or even already being in one,

by some measures), and facing the unenviable prospect of the loss of the dollar’s status as the world’s de facto reserve currency, which would deprive the nation of hundreds of billions of dollars’ worth of real goods, resources, and services, which it currently gets in exchange for its green pieces of paper.

Which Countries Enjoy Triple A Ratings?

With the US dropping off the pedestal of Fitch’s "highest credit quality" rated nations, only a

handful of countries in the world maintain the coveted AAA rating among the big three agencies, among them

Australia, Denmark, Germany, Luxembourg, the Netherlands, Switzerland, Norway, Sweden, and Singapore.

Other major economies’ rankings vary, from BBB- for India (the lowest rung of "lowest medium grade") to A or A+ for Japan ("upper medium grade"), BBB for Indonesia, BB- or BB for Brazil (“non-investment grade speculative”), AA or AA- for France and the UK.